Mentions in media – FT Adviser Article

Expert Guidance For Your Retirement

For over 24 years, I have been dedicated to helping people like you build a secure and prosperous retirement. As a Chartered Independent Financial Adviser, I provide expert, impartial advice tailored to your unique financial journey.

My specialism lies in negotiating the complexities of pension planning. I have extensive expertise in Defined Benefit and Final Salary pensions, ensuring you understand their true value and potential. If you have accumulated several pensions throughout your career, I can help you consolidate them into a single, streamlined scheme, bringing clarity, control, and ease of management to your savings.

The financial landscape is constantly evolving, which is why I am committed to continuously updating my knowledge through ongoing experience and industry-recognised qualifications. My process is built on two core principles: I am ready to listen to understand your goals, and I am ready to take decisive action to help you achieve them.

Whatever your pension needs may be, I have the experience and expertise to help.

Phillip Handley – Chartered IFA – (Adv DipFA)

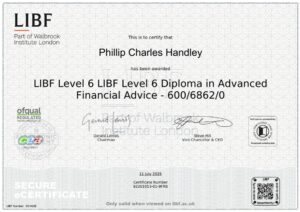

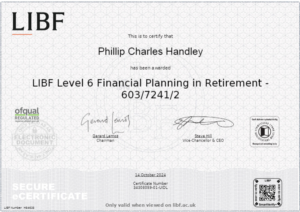

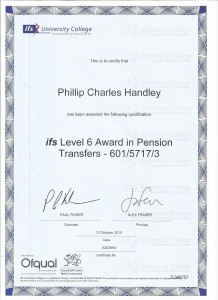

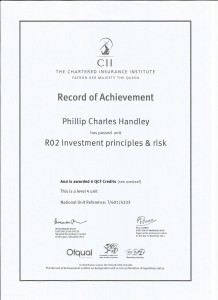

QUALIFICATIONS

Level 6 Diploma in Advanced Financial Advice (adv DipFA)

Level 6 Planning in Retirement (FPIR)

Level 6 Award in Pension Transfers

Level 6 Managing Investments (MANI)

- The principles and theories associated with measuring investment performance.

- Managing investment portfolios to achieve client objectives.

Level 6 Taxation, Trusts and Tax Compliance (TTTC)

- Developing a taxation and trusts strategy within an ethical framework.

- Advising UK clients on taxation and the administration of trusts.

Level 4 Diploma in Financial Planning

Level 3 Certificate in Financial Planning

RO2 Investment Principles & Risk

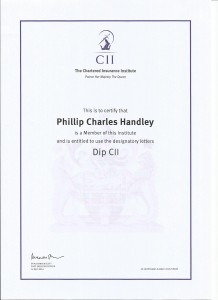

DIP CII

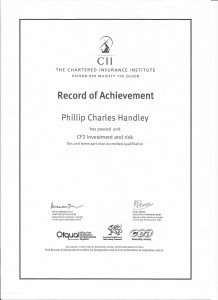

CF2 Investment & Risk

Life & Pensions

JO1 Personal Tax

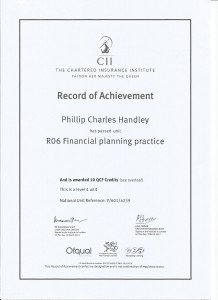

RO6 Financial Planning Practice

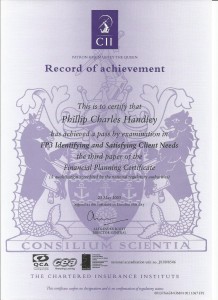

FPC 3 Identifying Clients Needs

FPC1 Financial Regulation

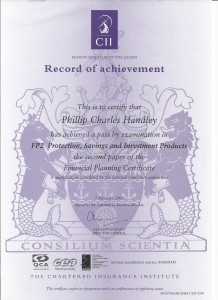

FPC2 Protection & Investments

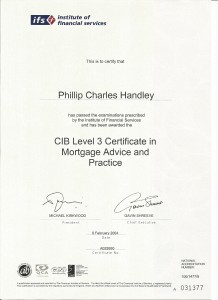

Level 3 Mortgage Advice

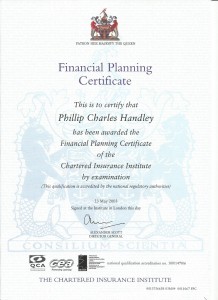

Financial Planning Certificate

MY PRACTICE AREAS

Final Salary

Occupational schemes based on your salary and length of employment.

Defined Benefit

Occupational scheme where you pension income benefits are know and not reliant on stock market performance.

Guaranteed Minimum Pension (GMP)

Contracted out, salary related pension benefit.

Guaranteed Annuity Rates (GAR)

Schemes offering a guaranteed income rate, irrespective of current market annuity rates.

Occupational Money Purchase

Occupational schemes with a varying fund value.

Guaranteed Level of Income

e.g. Under a Retirement Annuity Contact (RAC) or deferred annuity

Section 9 2 (b) Rights

i.e. contracted out pension service post 1997 under a scheme that contracts out on the Reference Scheme Test basis

Consolidation

Transferring many pension schemes into a new more cost effective and flexible plan.

“You can be young without money, but you can’t be old without it.”

Tennessee Williams