Mentions in media – FT Adviser Article

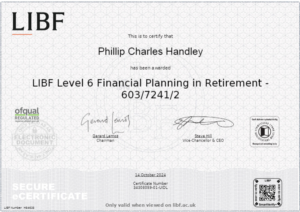

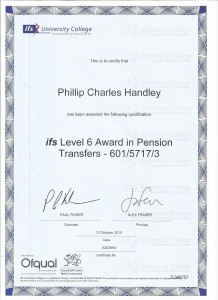

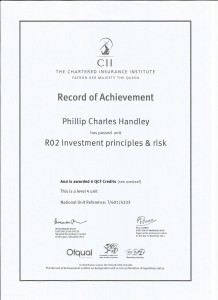

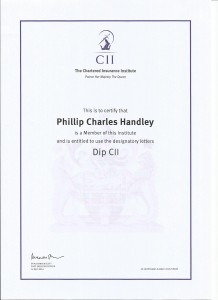

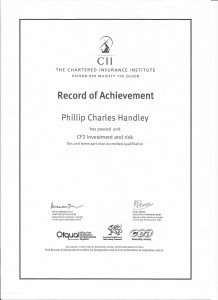

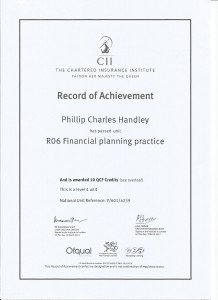

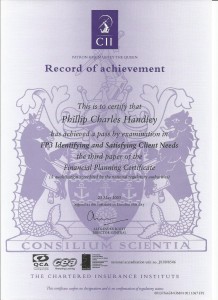

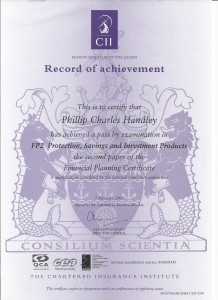

QUALIFICATIONS

I’m an Independent Financial Adviser who has been helping people secure their retirement for over 24 years. I have expertise in defined benefit and final salary pensions, and can help you consolidate any number of old or existing pensions into one easy-to-manage scheme. Whatever your pension needs may be, I’ll be able to help.

I’m continuously updating my knowledge through experience and industry-recognised qualifications so that when I talk to you, I’m ready to listen and take action.

Phillip Handley CeMAP AwPETR MLIBF FPIR

Level 6 Financial Planning in Retirement (FPIR)

Level 6 Award in Pension Transfers

Level 6 Managing Investments (MANI)

- The principles and theories associated with measuring investment performance.

- Managing investment portfolios to achieve client objectives.

Level 4 Diploma in Financial Planning

Level 3 Certificate in Financial Planning

RO2 Investment Principles & Risk

DIP CII

CF2 Investment & Risk

Life & Pensions

JO1 Personal Tax

RO6 Financial Planning Practice

FPC 3 Identifying Clients Needs

FPC1 Financial Regulation

FPC2 Protection & Investments

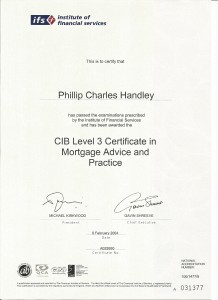

Level 3 Mortgage Advice

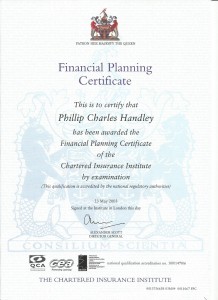

Financial Planning Certificate

MY PRACTICE AREAS

Final Salary

Occupational schemes based on your salary and length of employment.

Defined Benefit

Occupational scheme where you pension income benefits are know and not reliant on stock market performance.

Guaranteed Minimum Pension (GMP)

Contracted out, salary related pension benefit.

Guaranteed Annuity Rates (GAR)

Schemes offering a guaranteed income rate, irrespective of current market annuity rates.

Occupational Money Purchase

Occupational schemes with a varying fund value.

Guaranteed Level of Income

e.g. Under a Retirement Annuity Contact (RAC) or deferred annuity

Section 9 2 (b) Rights

i.e. contracted out pension service post 1997 under a scheme that contracts out on the Reference Scheme Test basis

Consolidation

Transferring many pension schemes into a new more cost effective and flexible plan.

“You can be young without money, but you can’t be old without it.”

Tennessee Williams