What is Defined Benefit Pension?

A defined benefit pension scheme is where the benefit of the pension income are known and which are based on both length of service and salary during employment. These schemes are the alternative to defined contribution schemes where the contributions are known during employment but the final income is based on a varying fund and options chosen at retirement.

Defined Benefit Scheme:

Defined benefit scheme are also regarded as ‘gold plated’ schemes for their valuable guaranteed benefit during retirement. These consist of an inflation proofed income, spouse’s benefit and guarantee to pay for life.

Consider the Lifetime Allowance before you transfer your defined benefit pension

Defined benefit schemes were created at a time when life expectancy was a lot lower that it is today. Schemes could therefore afford to pay members until their date of death and comfortably take on new members. Medical advances resulting in longer life expectancy has resulting in schemes having to pay out for longer and becoming unsustainable in recent times. Many defined benefit schemes have been closed to new members being replaced by defined contribution schemes which doesn’t put any burden on the employer.

The pension reforms of 2014 largely ignored making any changes to those in defined contribution schemes and concentrated on giving more access and flexibility to those with defined contributions and personal pension schemes.

The only way for a defined benefit scheme member to take advantage of the freedoms is to give up their benefits and take a cash equivalent transfer value, and move to a personal pension arrangement.

For member protection, the Financial Conduct Authority has put measures in place to ensure anyone looking to move their guaranteed benefits, can only do so, after seeking professional financial advice.

Defined benefit scheme have fantastic benefits but a very inflexible. They can only be taken based on how the scheme rules stipulate and crucially no benefit can be passed on to anyone other than the spouse or partner (except for dependent children in full-time education up to max age 23). For people with larger defined benefit schemes, this has become the main catalyst in the desire to transfer.

A scheme with an annual income of £15,000 a year, might be worth £400,000 as a transfer value. That’s a large amount of money to be lost back to the scheme if the member were to die early without a spouse or partner.

As the ‘pension freedoms’ now allow funds to be passed on to any beneficiary, those looking to protect their wealth might wish to transfer to a personal pension arrangement and have more flexibility with their fund rather than accept the pre-defined guarantees of an occupation defined benefit scheme.

How are defined benefit pensions managed:

Member of defined benefit pension schemes don’t need to worry about managing the day to day fund as their benefits are guaranteed at retirement, no matter how the underlying fund performs. This is different from defined contribution pension members who’s retirement wealth is dependent on their own fund performance.

Defined benefit members are paid their guaranteed income from the scheme, and it’s therefore important for the scheme to manage the funds in such a way that there is enough in the pot to pay all current and past members who are still alive.

Managing a scheme pension is a huge task and often involves a team of people with different expertise.

A typical team should be made up of Pension Analysists, Experienced research managers, Pensions Strategists & Investment managers. The scheme is run by a Board of Trustees on behalf of the scheme employer and they are responsible for all aspects of the scheme from paying out benefits to retired members.

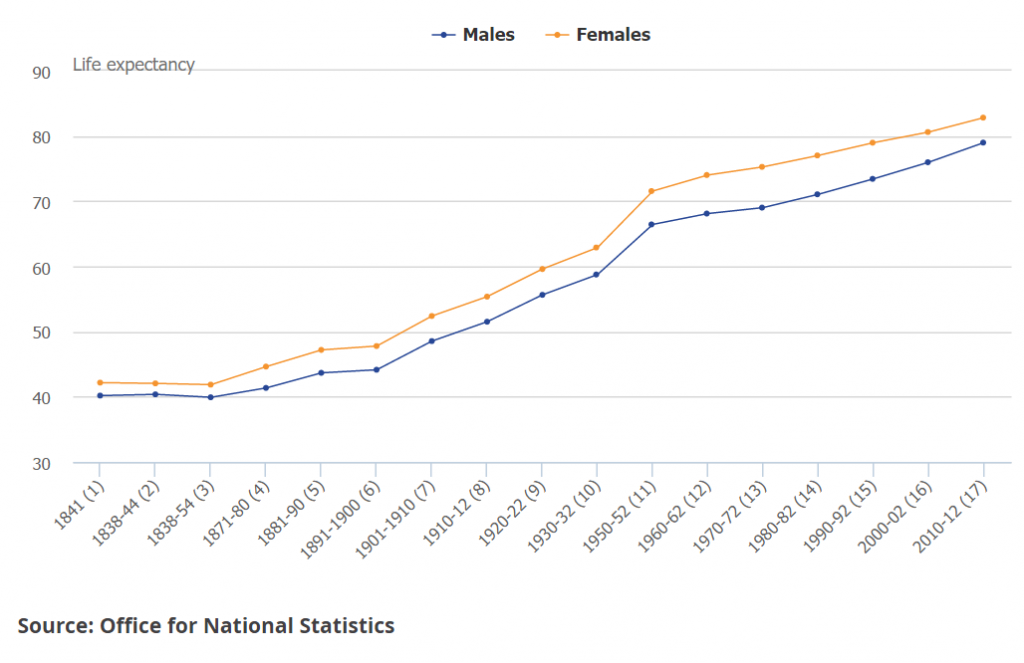

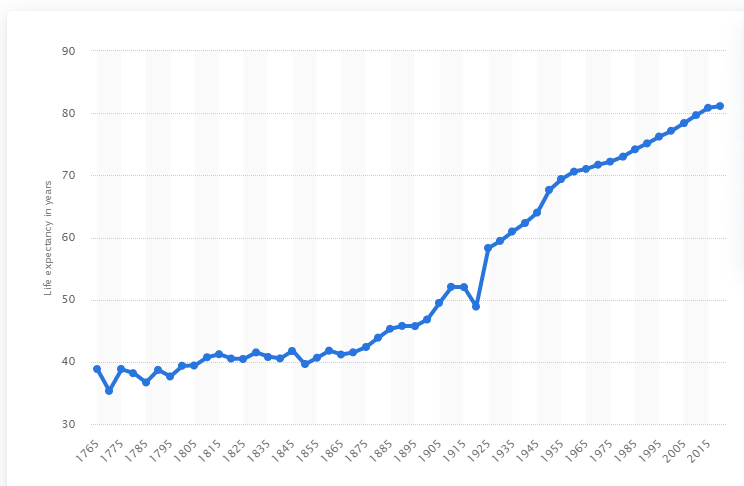

With an aging population defined benefit schemes are having to pay out more than they were initially designed to do. When defined benefit scheme gained popularity in the 2nd half of the 20th century the average age of death was around age 70 (in 1960). Defined benefit pension were therefore sustainable as the scheme didn’t anticipate paying out the guaranteed pension benefits for an extended period of time. However, as health and general wellbeing improve over the years, scheme were having to find more and more funds to pay those members who hadn’t died.

The chart above shows how rapidly average life expectancy improved through the 20th century.

The resulting problem was that many scheme pensions became unaffordable to keep running as those living longer were draining the fund as there weren’t enough current members to pay for the increased costs.

Many schemes are now underfunded, meaning there isn’t enough value in the total pot to pay all existing and retired members. It is, therefore, the role of those managing the fund to rectify and solve this issue.

Managing market volatility, regulatory challenges, uncertain liabilities, and pressure to reduce underfunding all falls on the management team.

When can you take a defined benefit pension?

Defined benefit/final salary schemes are set up to pay out at a normal retirement date (NRD). This is specific to the scheme and can be any time from age 50 to 67. The NRD is usually used to illustrate what income a member can expect to achieve at a fixed retirement date.

A member can ask the scheme for an earlier retirement to the NRD; however, this may be heavily penalised. As the scheme will effectively need to pay out for more years, an early retirement factor is applied, leading to a reduced income offer from that offered at NRD.

The Process of withdrawing money from your defined benefit pension

There are usually two options offered when withdrawing income from a defined benefit scheme.

- Full Pension Income

- Tax-Free Cash and Income

Full income is the maximum amount of income offered based on the clients years of service and salary during that period. The income offer is fixed and can’t be negotiated. The income will include a spousal/partner benefit, and in most cases, inflation proofing, meaning the income will go up by the average living cost each year.

Tax-Free cash and income are where some of the income is sacrificed for a tax-free cash lump sum. Usually, the member is offered the maximum available; however, a lower amount of tax-free cash can be asked for in exchange for income increases. Tax-free cash can be taken anywhere between none and the maximum available.

Members would usually be sent their option pack a few months before their NRD and asked to send back in their signed request declaration. The income would then start on or shortly after the stated NRD.

The member would provide a nominated bank account for the pension income to be paid into, and all the income tax would be paid at source, much like PAYE.

Risks of taking a defined benefit income

Unlike defined contribution pensions, there isn’t any investment risk.

However, defined benefit pensions have other risks to consider.

Inflexibility risk – Once the pension income starts, it can’t be reversed. The income can’t be changed, started, stopped, or exchanged for another retirement product such as an annuity or drawdown. If someone’s situation changes shortly after taking the income, they may find it no longer suitable for their needs or inappropriate for the objectives. Unfortunately, nothing can be done to change the plan making it very inflexible.

Early Death – Defined benefit pensions are excellent for providing a lifetime income. Still, if a member dies relatively early after taking the pension, the only benefit is a spousal income, usually half of the member’s income. In this scenario, it’s unlikely the remaining spouse would see the full value of the pension through their 50% reduced income. Some schemes offer a dependant income, but this is only usually available until full-time education stop.

If someone is single with no dependents and dies, there are no benefits to be paid to their estate. The pension simply dies with them.

In simple terms, if a member dies young, the scheme wins; if a member lives longer than expected, they win.

With defined benefit transfer values being offered to members, people can now see how much their pension is worth as a lump sum value instead of just an annual income. This led to people wanting to preserve this lump sum value by transferring to a defined contribution scheme, where any remaining value can be passed on to the family on death. The risk with defined benefit schemes is, therefore, the possibility of losing the pension value from the estate on early death.[/column]