Those with final salary of defined benefit pension plans, who were looking to transfer their benefits may be in luck.

The vote to leave the EU has, as experts predicted, had some negative economical effects. One of which resulted in gilt yields falling to historic lows.

Why is this important?

Well, gilt yields are largly responsible for annuity rates (along with longevity), and as these fell, so did the underlying annuity rates of many providers.

Source AMS annuity.

The bad news for those with defined contribution schemes looking to buy an annuity was the opposite for those with defined contribution schemes looking to transfer out.

The calculations involved in the offer of a Cash Equivalent Transfer Value (CETV) for a member, involves, amongst other factors, the use of gilt rates to try an offer a fair value. A transfer value which, if invested correctly could try an offer similar benefits to those offered within the scheme by purchasing an annuity.

The CETV is designed to represent the value of the benefits being given up. It’s the Scheme Actuaries job to look at all current economical factors, and offer a fair value with certain assumptions built in.

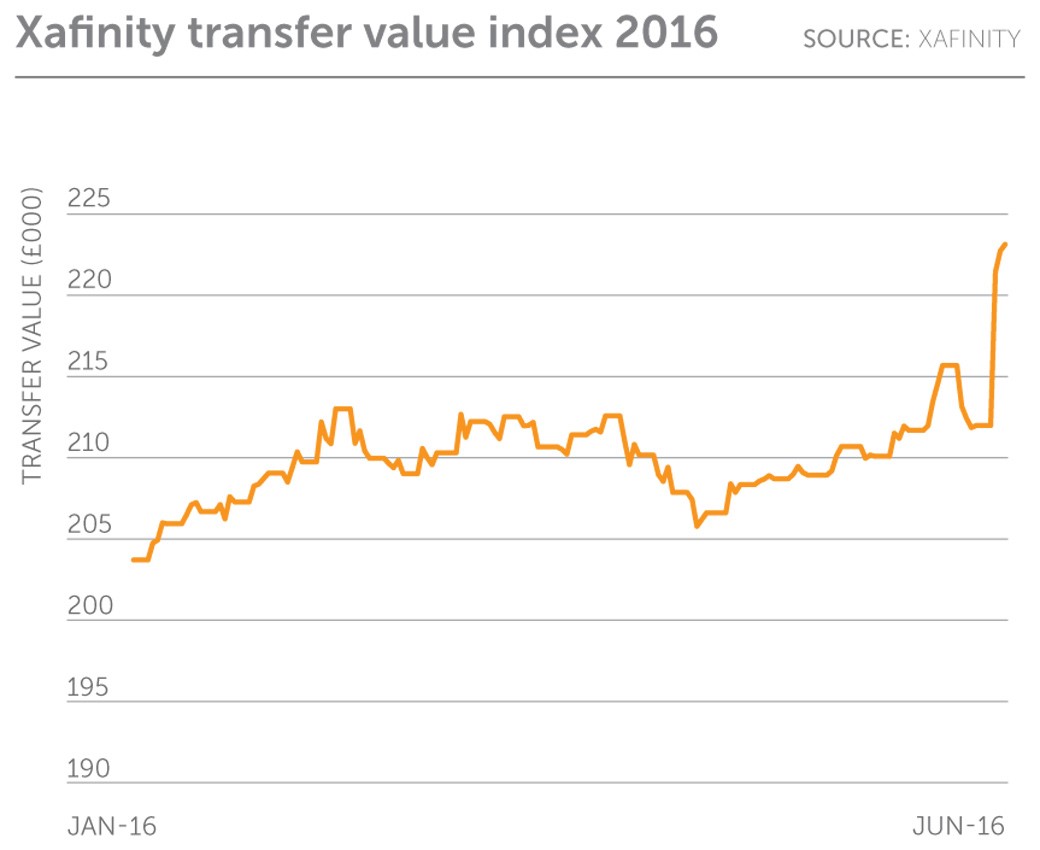

The result of which currently leads to the highest transfer value calculations for a few years. Xafinity’s transfer value index was 4% higher than the highest level in 2015 on the 30th June.

So what are the reasons people might be looking to transfer?

Well, it’s a difficult pill to swallow knowing that a lifetimes pension savings could be lost back to the scheme if the member dies shortly after retirement. DB scheme were largely missed of any pension freedoms and so the rules regarding flexibility and ability to pass assets on are fixed.

For the most part this means, 50% spouses benefit with no ability to pass funds on to children or any other party the member wishes, unlike Defined Contribution schemes.

Transferring benefits away from Defined Benefits schemes gives up the rights to the safeguarded benefits but does offer more flexibility.

We’d always encourage defined benefit/Final Salary scheme member to ask for a Cash Equivalent Transfer Value to understand what their scheme is worth. Generally the scheme will allow one free valuation per years and it doesn’t affect any rights or benefits within the pension.

Learn more: What affects defined benefit transfer values

Write a comment: